|

|

|

| [[Opt In Top]] |

| Monthly Roundup |

| #Listrak\DateStampLong# |

The latest news from the State Capitol |

Community Highlights

The fair season has come and gone for our district. This summer I had legislative booths at the Fayette County Fair and the Bullskin Fair. I was able to speak with many of you who came out to these fairs as well as enjoy the great food, the fun atmosphere, and time with my kids.

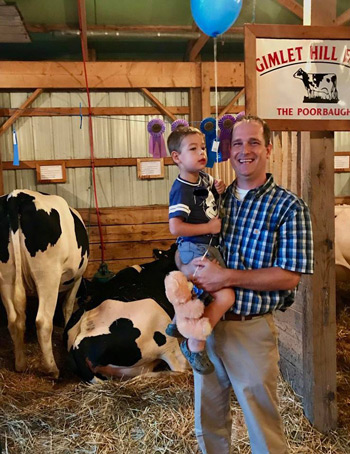

Here are a few photos from both the Fayette County and Bullskin fairs:

|

| My son, Ben, and I enjoyed our time at the Bullskin Township Fair. |

|

| Rep. Matt Dowling and I hosted our legislative booth at this year’s Fayette County Fair. |

|

Help for PA Business Owners and Startups

Entrepreneurs looking to plan, operate or grow a business in the Commonwealth have a great new online resource.

The Pennsylvania Business One-Stop Shop connects and guides business owners through all stages of development, from planning and startup to operating and expanding.

The easy-to-navigate website is backed by a team of business consultants and subject matter experts providing entrepreneurs and small businesses access to the resources, tools and experience they need to succeed.

Questions about the Pennsylvania Business One-Stop Shop can be submitted electronically by clicking here or by calling 833-722-6778 and pressing Option 0 to speak with a team member.

|

State Rebates Available for Alternative Fuel Cars

The Pennsylvania Department of Environmental Protection (DEP) is offering rebates of up to $2,000 for Pennsylvania residents who purchase alternative fuel vehicles. Rebates are available depending on the type of vehicle purchased. Eligible vehicles are plug-in hybrid, plug-in electric, natural gas, propane, and hydrogen fuel cell vehicles.

To be eligible for a rebate, a new alternative fuel vehicle (AFV) must have a manufacturer’s suggested retail price of $60,000 or less and must have an odometer reading of less than 500 miles. One-time preowned AFVs with 75,000 miles or less and a true market value of $50,000 or less are also eligible for a $750 rebate. Leased vehicles are also now eligible for rebates, a change that allows additional flexibility for residents. An additional rebate of $500 for pre-owned vehicles is available to residents with a household income below 200 percent of the federal income poverty level.

Rebates will be awarded in the order that the request forms and required documentation are received and approved, not the date a vehicle was purchased. Consumers may submit applications up to six months after the date of purchase. Consumers should be aware that funds may be depleted before their rebate application can be processed.

Flexible fuel, non-plug-in hybrid and biodiesel vehicles are not eligible. Rebates issued as a part of this program are taxable income and will result in the issuance of a 1099 form for the taxable year in which the rebate was received.

For program guidelines, application instructions, and an up-to-date listing of rebate availability, click here.

|

Labor and Industry Committee Examines Key Employment, Workplace Issues

The House Labor and Industry Committee conducted three public hearings this week on issues of interest to both employees and employers across the state.

On Wednesday morning, the committee heard testimony regarding the potential impacts of the Wolf administration’s proposed changes to the executive, administrative and professional exemptions from state minimum wage and overtime requirements under the Pennsylvania Minimum Wage Act. The proposal would make Pennsylvania’s rules significantly different than federal law.

In the afternoon, the committee turned its attention to legislation, House Bill 2571, which seeks to ensure nonmembers of public sector unions are made aware of their right not to contribute money to the representative union. The bill was introduced after the United States Supreme Court ruled forced union dues from nonmembers is a violation of those workers’ First Amendment rights. As such, public employees cannot be forced to pay a fair share fee – or any other money they did not consent to pay – to a public labor union.

Legislation to address workplace harassment, sexual misconduct and discrimination were the focus of the committee’s hearing on Thursday morning. The proposals include an expansion of the application of the Pennsylvania Human Relations Act, requiring more detailed Employment Fair Practices notices, and making it easier for workers to report problematic behaviors to their employers.

|

Aging Committee Discusses Updates to Law Protecting Senior Citizens

Working to ensure the health and safety of Pennsylvania’s senior citizens, the House Aging and Older Adult Services Committee held a two-day hearing this week to examine proposed changes to the Older Adult Protective Services Act.

House Bill 2549 seeks to make a number of changes to the act, including changing background check requirements to refine employment bans for people convicted of certain crimes. The legislation also would require financial institutions in the Commonwealth to provide employees with specific training in recognizing signs of potential financial abuse of an older adult and the process to make an abuse report.

Testifiers included Aging Secretary Teresa Osborne, senior citizen care provider organizations, AARP and the Pennsylvania Association of Area Agencies on Aging.

|

|

| Office Locations |

| Capitol Office: Room B-11, Main Capitol Building, PO Box 202052, Harrisburg PA 17120-2052 | (717) 787-1540 |

| District Office: 1040 Eberly Way, Suite 250, Lemont Furnace, PA 15456 I Phone: (724) 437-1105 |

| Email: rwarner@pahousegop.com |

|

|